Energy users inside competitive retail markets ought to cash in on the advantages obtainable to them, together with selecting their energy provider, like Constellation, and also the Reliant Energy Plans ability to structure their electricity acquisition ways in a very means which will take advantage of each worth and risk.

Uncontrollable vs. Controllable Factors

Many different factors will affect the worth of energy, together with uncontrollable factors and governable factors. Uncontrollable factors embrace the weather, the economy, and alternative difficult-to-predict market factors just like the sedimentary rock revolution, which has exaggerated gas production, surpassing demand and lowering energy costs across the board.

However, a vital governable issue that customers ought to take into account is that the structure of their power provides contract.

Consumers in competitive markets will choose power contracts that vary from monthly to annual to multi-year agreements and choose between a spread of shopping for structures. These embrace “Fixed worth,” “Index” and “Blended” choices.

These choices have given customers new flexibility to align their energy value strategy with company goals, budgets, risk tolerance, and financial calendars.

What is the most effective Structure?

While not all energy getting desires square measure created equal, neither square measure all power getting ways. analysis from Constellation found that sure ways perform higher compared to others, however solely in specific market conditions, like a recession and polar vortex.

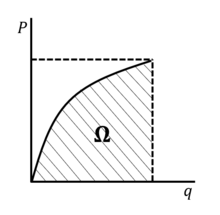

The analysis showed that despite clearly completely different market conditions, one truth remains constant: A “blended” strategy is usually the most effective thanks to purchasing power for many businesses concerning the reconciliation of each worth and risk. See leads to the graphic below, wherever the coordinate axis represents risk and the coordinate axis represents worth.

How to Approach intermingled Energy ways

Each business is exclusive, and whereas basing the approach on business desires and goals may be terribly helpful, it’s conjointly necessary to think about risk tolerance, usage patterns, and even incorporation of automation.

Risk Tolerance

For a lot of correct budgeting and coming up with, businesses typically like better to minimize risk. However, there square measure ways to require advantage of market variations whereas reducing risk. for instance, getting a proportion of load at regular intervals over time – referred to as layering – instead of all quickly, provides not solely budget foregone conclusion however conjointly permits the choice of taking advantage of market opportunities.

Usage Patterns

When and the way an organization uses energy is very important. will your business use a lot of energy within the summer or the winter? Is your business a 24/7 operation that uses an equivalent quantity of power throughout the day, or is seventy-five % of the power used throughout the day?

Answers to those queries facilitate determine ways that to require risk and supply budget certainty within the getting approach. Constellation’s Energy Manager application will assist you monitor and notice patterns in your energy usage and is offered at no charge to customers.

Automation

Rather than worrying regarding whether or not the correct getting call is being created at the correct time, some or all of AN organization’s power getting may be machine-driven. an automatic, recursive approach will facilitate success a lot of consistent acquisition method over time and take the estimation out of the choice. Constellations Minimize Volatile evaluation permits customers to diversify and automatize their energy getting overtime.

Whether or not an automatic or manual methodology is employed, our ANalysis incontestible that it’s most helpful to own a minimum of some portion of load incorporating an index worth (i.e., customers would pay a variable index rate just like the Day-ahead or period index for his or her electricity) to confirm the “blended” strategy ultimately pays off each price- and risk-wise.